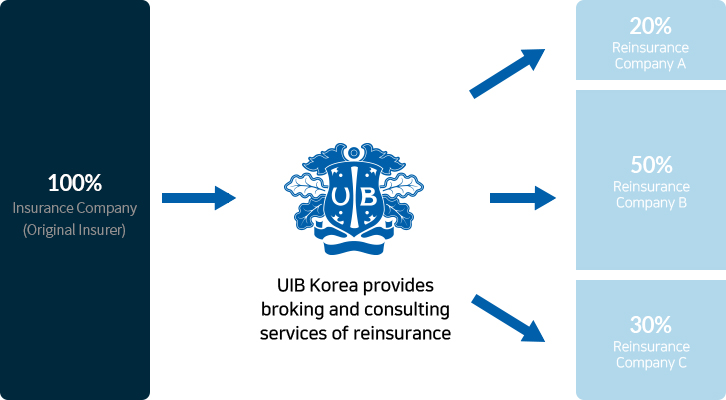

Reinsurance is the practice whereby insurers transfer portions of their risk portfolios to other parties by some form of agreement in order to mitigate risk.

In other words, it is described as “insurance of insurance companies”.

- - Facultative Reinsurance

- Facultative reinsurance is reinsurance purchased by an insurer for a single risk or a defined package of risks.

- It is contained in a single transaction, and is called facultative because the reinsurer has the power of “faculty” to accept or reject the offered risk.

- - Treaty Reinsurance

- Treaty reinsurance is a form of reinsurance in which an insurer transfers all risks within a certain class of business to the reinsurer.

- The reinsurer agrees to accept all policies that fall within the agreement, known as the “treaty”.

UIB Korea Service

Facultative Reinsurance

- Provide facultative reinsurance market intelligence

- Obtain competitive rates

- Secure stable reinsurance capacity

Treaty Reinsurance

- DFA analysis & Simulation

- Treaty structure design

- Technical Pricing

- AIR / RMS Modeling Analysis

- JBA flood Modeling

- Professional Actuarial Service (including Structured Solutions)

- Solvency Capital Assessment

- Reinsurance training service

- Arrange meetings with reinsurance companies and renewal road show

- Monitor reinsurers' credit ratings, M&A status, etc.

- Provide insurance and reinsurance report and key market intelligence

- Obtain competitive rates

- Secure stable reinsurance capacity

Business Line at UIB Korea

TREATY

- Proportional treaty (QS, Surplus, F/O)

- Non-proportional treaty (XOL, Stop Loss, Structured Layer, Aggregate XOL, etc.)

- All lines including Property, Liability, Marine, Specialty line (Crop, Livestock), Life, etc.

FACULTATIVE

Casualty

- Liability: Commercial General Liability, Project liability, Product liability, etc.

- Financial Lines: D&O, PI, PIP, EFTL, Cyber, Medical malpractice, etc.

- Specialty 1: Terrorism, K&R, PA, etc.

- Specialty 2: EW, RVI, Political Violence, M&A, Facility, INT E&O, Livestock, etc.

Construction & Property

- Power Plant (CCPP, TPP, CHP)

- Oil & Gas, Petrochemical Plant

- Onshore and Offshore Solar/Wind Power, ESS

- Wet Risk (Breakwater, Port, etc.)

- Civil Works (Railways, Roads, Bridges/Tunnels,Airports, etc)

- Apartment Complex, Buildings, Warehouses, etc.

Marine & Aviation

- Cargo, Project Cargo, Fine Art, Species

- P&I, Marine Liability ( Port & Terminal, Logistics)

- Hull, Shipbuilding, War

- Aviation (Hull & Liability), Space